Convertir Dollar en Franc Cfa

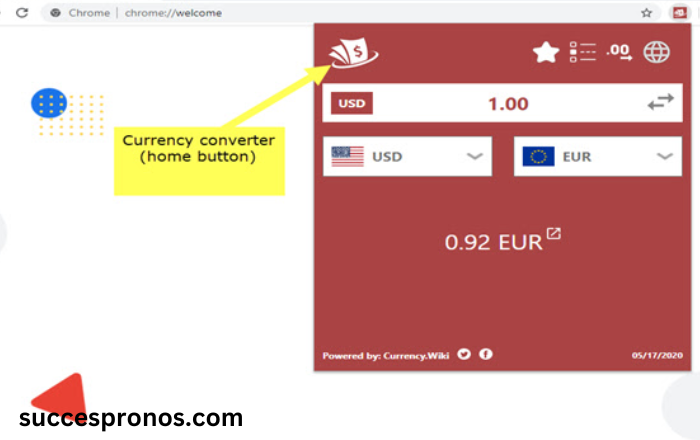

When it comes to international currency exchange, Convertir Dollar en Franc Cfa is a common task for individuals and businesses in West and Central Africa. The CFA Franc is the official currency of 14 African countries, while the U.S. Dollar is widely used across the globe. Understanding how to convert dollars to CFA Francs efficiently is important for anyone traveling to these regions, conducting international business, or working with investments. By knowing the process and factors involved in Convertir Dollar en Franc Cfa, individuals can make more informed financial decisions.

Whether you are planning a trip to a CFA Franc zone, sending money to family, or purchasing goods and services, understanding the exchange rate between the U.S. Dollar and CFA Franc is crucial. The process of ...